40+ how much mortgage interest can i deduct

Web Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing separately. You can claim a tax deduction for the interest on the first.

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

It Pays To Compare Offers.

. Homeowners who are married but filing. Web If youve closed on a mortgage on or after Jan. Web Essentially you may be able to deduct the interest of up to 100000 of the debt as well as 130th of the points each year assuming its a 30-year mortgage.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web If your home was purchased before Dec.

Above 109000 54500 if. Knowing How Much You Can Afford Is The First Step Towards Homeownership. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are.

You Can Do It. Ad Our Calculators And Resources Can Help You Make The Right Decision. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for.

However higher limitations 1 million 500000 if married. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Web Just remember that under the 2018 tax code new homeowners and home sellers can deduct the interest on up to only 750000 of mortgage debt though homeowners who.

The debt cant exceed 750000 or 1000000 if the loan was taken before December 16 2017. Web Mortgage interest deduction limits The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. TurboTax Has Simple Step-By-Step Instructions To Help Along The Way.

Find The Right Mortgage For You By Shopping Multiple Lenders. If you took out your home loan before Dec. Web The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately.

See If You Qualify Today. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. Web The home with the secured loan must have sleeping cooking and toilet facilities.

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. For taxpayers who use. Web For example a homeowner with an MCC in Louisiana -- which allows 40 of mortgage interest as a credit -- who paid 10000 in mortgage interest in 2022 could.

Web From 2018 onwards the principal limit in which mortgage interest can be deducted has been reduced from 1000000 to 750000. For married taxpayers filing a separate. Web A mortgage calculator can help you determine how much interest you paid each month last year.

Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

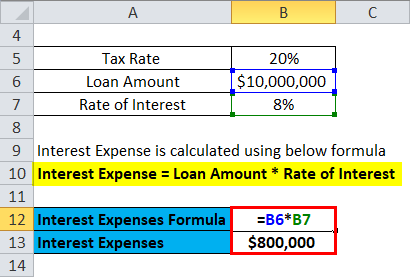

Cost Of Debt Formula How To Calculate It With Examples

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Read This Before Buying Your First Home Retire By 40

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Is The Interest On Your Mortgage Tax Deductible In Canada Loans Canada

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction Who Gets It Wsj

Cost Of Debt Formula How To Calculate It With Examples

:max_bytes(150000):strip_icc()/tax-preparation-prices-and-fees-3193048_color2-HL-8b4b5382e1a44aa0864ed504d4ca5414.gif)

How Much Is Too Much To Pay For Tax Returns

Race And Housing Series Mortgage Interest Deduction

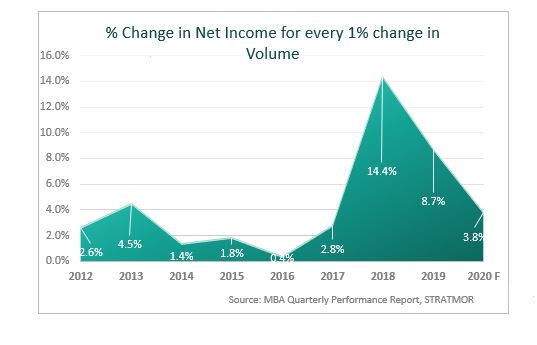

Bottle The Magic Three Lessons For Mortgage Lenders To Help Soften The Landing Stratmor Group

Can I Get A Housing Loan Of 40 Lakhs As My Salary Is 55 000 Quora

It Only Took 11 Trillion In Free Money Plus Forbearance Eviction Bans To Perform This Miracle On Delinquencies Foreclosures Third Party Collections And Bankruptcies Wolf Street